VISLAND MORTGAGES

$501 Billion in Canadian Mortgages will renew by the end of 2025.

Are you one of them?

Nanaimo's Top Rated Mortgage Brokerage is here to help!

About VIsland Mortgages

Vancouver Island Mortgage is now in full swing with a highly skilled Team that has the capacity to grow the business to new heights.

Bill Fraser

Your Personal Mortgage Advisor

Bill has over 20+ years working in the financial industry. Due to his extensive experience and knowledge he works efficiently with all lenders including: banks, credit unions, trust companies, financial institutions and mortgage investment companies. He is also able to offer his clients a variety of choices within his hundreds of products and services offered. These products include mortgages for purchasing new homes or investment properties, refinancing existing homes, debt consolidation, home equity line of credit, second homes, commercial as well as alternative or private lending. There is always an option when you deal with Bill Fraser!!

A 60 second introduction video to

VISLAND Mortgages

Services

Flexible Mortgages

Qualified Advice

No Cost to You

Advocacy

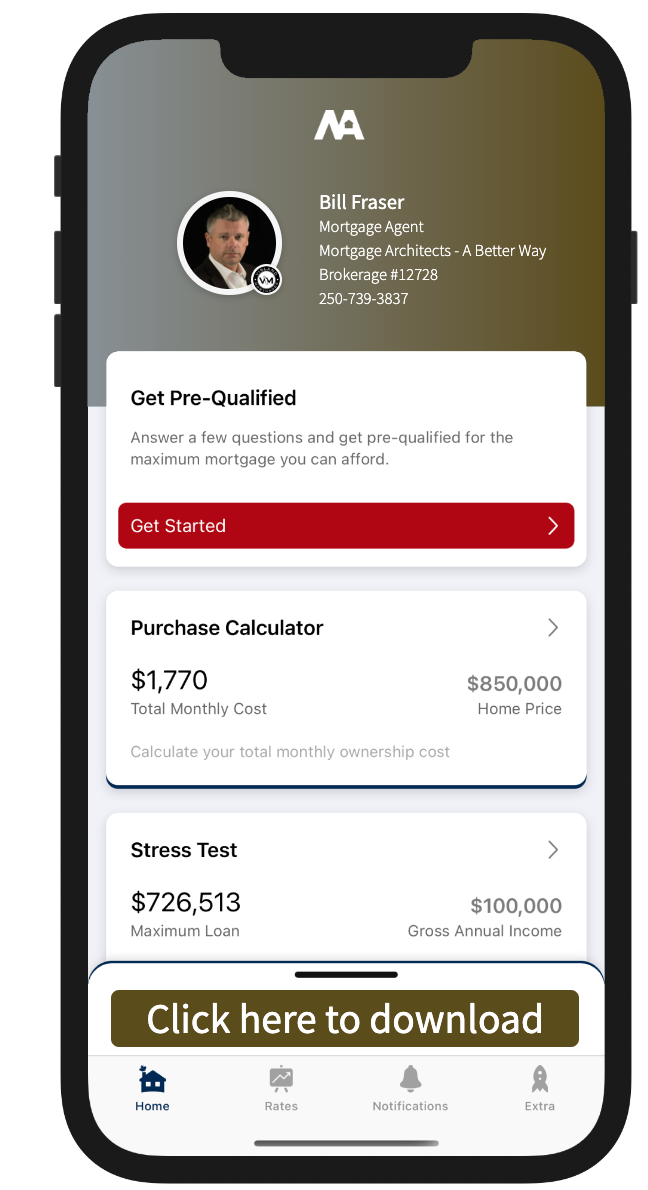

Download My Mortgage Toolbox

Access the calculators in 3 easy steps

- Add your phone number below

- Download the app

- Create an account

WHAT CAN YOU DO ⤵

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

I'M A CERTIFIED REVERSE MORTGAGE SPECIALIST

Let's see if a reverse mortgage is right for you.

LEARN MORE

Lenders

Testimonials

Mortgage Blog